What is GST (Goods and Services Tax)?

Welcome to Infinity Compliance,

What is GST (Goods and Services Tax)?

The goods and services tax (GST) is a tax levied on most goods and services sold for domestic consumption. The GST is paid by consumers, but it’s remitted to the govt by the companies selling the products and services.

In other words, Goods and Service Tax (GST) is levied on the availability of products and services. Goods and Services law in India is a comprehensive, multi-stage, destination-based tax that’s levied on every value addition. GST may be a single domestic tax law for the whole country.

Multi-stage taxation

A product goes through multiple stages before it’s consumed by the end-user. These stages are similar to those of a supply chain.

For instance, the availability chain of a product involves the subsequent stages:

Purchase of raw materials

Manufacturing of a product,

Selling the merchandise to a wholesaler, then to a retailer

Sale to the end consumer

GST is levied on each stage mentioned above, which makes it a multi-stage tax.

Who introduced GST in India?

Prime Minister Narendra Modi launched GST into operation on the midnight of 1 July 2017. But GST was almost 20 years within the making since the concept was first proposed under the Atal Bihari Vajpayee government. The development of GST took many consultations, negotiations, and revisions before it had been launched in its final form in 2017. The launch of GST was also made difficult by the very fact that it required a Constitutional Amendment, and hence, a two-thirds majority approval within the Parliament, and a nod of more than at least half of the states.

Why was Goods & Services Tax(GST) implemented?

Goods & Services Tax was implemented to improve the assortment of duties at each nodal point and to coordinate the nation through a uniform GST tax rate.

By evacuating the lengthy list of indirect taxes imposed independently by the states and the center, the Indian economy would likewise get an outstanding boost. GST was executed after these four bills were passed by the administration: Goods and Services Tax Bill, Compensation GST Bill, Integrated GST Bill, and Union Territory GST Bill.

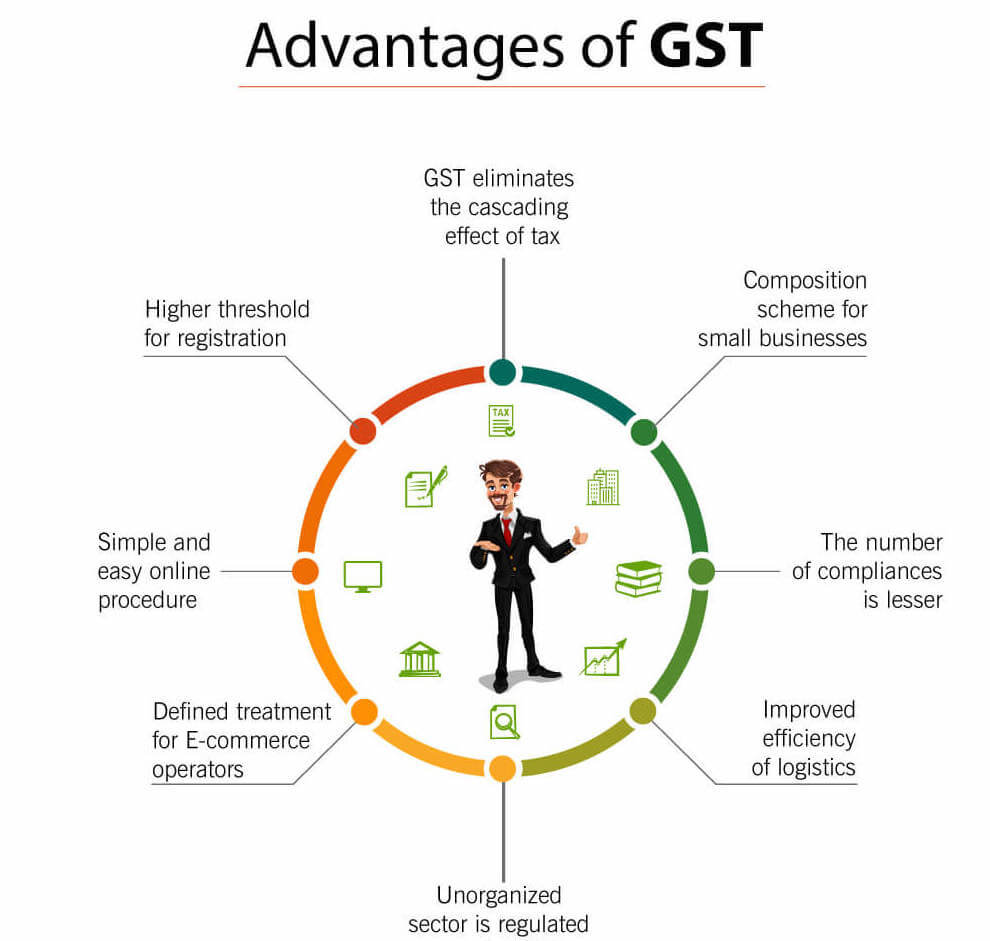

What are the benefits of GST?

– For business and industry

- Easy compliance: a strong and comprehensive IT system would be the inspiration of the GST regime in India. Therefore, all taxpayer services like registrations, returns, payments, etc. would be available to the taxpayers online, which might make compliance easy and transparent.

- Uniformity of tax rates and structures: GST will make sure that tax rates and structures are common across the country, thereby increasing certainty and simple doing business. In other words, GST would make doing business within the country tax neutral, regardless of the selection of place of doing business.

- Removal of cascading: A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would make sure that there’s minimal cascading of taxes. This would reduce the hidden costs of doing business.

- Improved competitiveness: Reduction in transaction costs of doing business would eventually cause an improved competitiveness for the trade and industry.

- Gain to manufacturers and exporters: The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services, and phasing out of Central Sales Tax (CST) would scale back the value of locally manufactured goods and services. This will increase the competitiveness of Indian goods and services within the international market and provides a lift to Indian exports. The uniformity in tax rates and procedures across the country also will go an extended way in reducing the compliance cost.

– For Central and State Governments

- Simple and straightforward to administer: Multiple indirect taxes at the Central and State levels are being replaced by GST. Backed with a strong end-to-end IT system, GST would be simpler and easier to administer than all other indirect taxes of the Centre and State levied thus far.

- Better controls on leakage: GST will end in better tax compliance thanks to a strong IT infrastructure. Due to the seamless transfer of input decrease from one stage to a different within the chain useful addition, there’s an in-built mechanism within the design of GST that would incentivize tax compliance by traders.

- Higher revenue efficiency: GST is predicted to decrease the value of collection of tax revenues of the govt, and will, therefore, cause higher revenue efficiency.

– For the consumer

- Single and transparent tax proportionate to the worth of products and services: thanks to multiple indirect taxes being levied by the Centre and State, with incomplete or no input tax credits available at progressive stages useful addition, the value of most goods and services within the country today are laden with many hidden taxes. Under GST, there would be just one tax from the manufacturer to the buyer, resulting in transparency of taxes paid to the ultimate consumer.

- Relief in overall tax burden: due to efficiency gains and prevention of leakages, the general tax burden on most commodities will come down, which can benefit consumers.

What are the different types of GST?

- Central GST (CGST): GST paid on each transaction is divided into two equal parts: the part for the Centre is termed as CGST.

- State GST (SGST): The part of a state’s share of GST, when a transaction takes place within the state, is called SGST.

- Union Territory GST (UGST): When a transaction takes place within a union territory (UT) without a legislature, the part of GST that the UT gets is named UGST.

- Integrated GST (IGST): When a transaction takes place between two states/UTs or between a state/UT and any foreign territory, IGST is levied without any bifurcation on the applicable GST rate.

What items aren’t taxed or covered under GST?

There are a couple of products, which weren’t under the purview of GST till long after its launch.

- Alcohol for human consumption: On alcohol, the facility to tax remains with the states.

- Petroleum products: GST wasn’t imposed on five petroleum products — petroleum, diesel, petrol, gas, and ATF.

- Tobacco: alongside GST, the Central Government has the facility to levy additional excise duty on tobacco products.

- Entertainment tax: the facility to make a decision on entertainment tax levied by local bodies remains with the states.

Also, there are some exceptions on Indian Railways tickets, where rather than the destination, the origin of the journey is taken into consideration. for instance, if Rajdhani Express is registered in Delhi, on the tickets from Delhi, CGST and SGST are going to be levied, while IGST is going to be charged when the journey originates at an area aside from Delhi.

GST Registration

Under the GST law, businesses with turnover exceeding Rs 40 lakh*

(Rs 10 lakh for North-Eastern States, J&K, Himachal Pradesh, and Uttarakhand) is compulsorily required to get GST registration. The limit is applicable to the supplier of products only.

The threshold remains to be Rs 20 lakh and just in case of special category States at Rs 10 lakh for the service providers.

*CBIC had notified the rise in threshold turnover from Rs 20 lakh to Rs 40 lakh which came into effect from the first of April 2019.

Documents Required for GST Registration:-

Applicant PAN Card

Aadhaar Card

Business Address Proof

Bank Account statement/Cancelled cheque

Business Registration Proof or Certification of Incorporation

Director/Promoters Identity Proof

Director/Promoters Address Proof

Director/Promoters Photo

Board Resolution/Letter of Authorization for Authorized Signatory

Digital Signature