Description

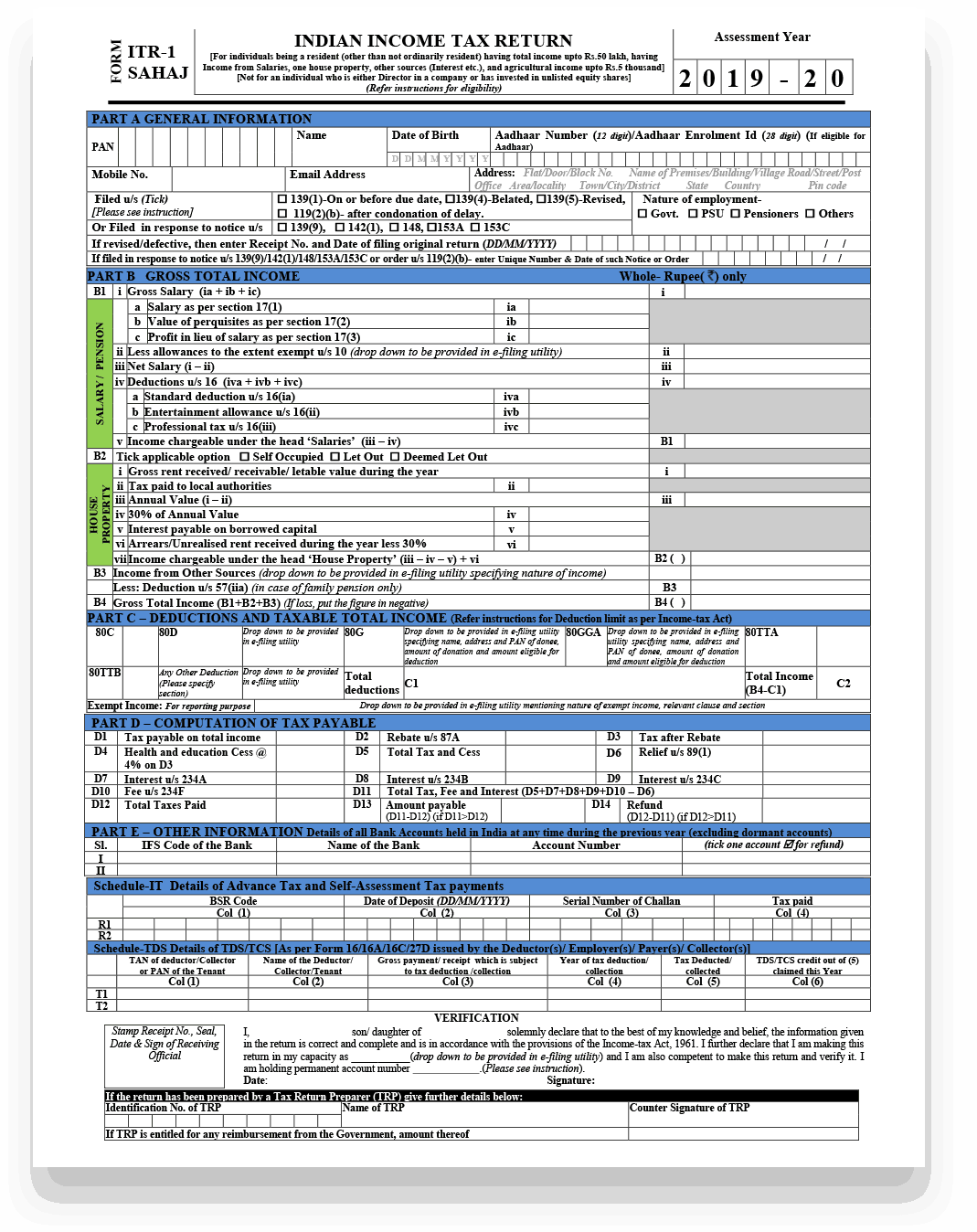

What is ITR-1 or Sahaj?

In order to simplify the return filing process, the income tax department has categorized taxpayers into many groups based on income and its source.

ITR1, also known as Sahaj, is applicable for individuals or HUF (Hindu Undivided Family) with an income up to Rs. 50 lakhs. It is a single page form. In this, you have to give a detailed break-up of your income from salary and house property (if applicable). The ITR form also asks you to provide details of the value of perquisites, non-exempt allowances, interest paid on borrowed capital among other details.

Who can file ITR 1 or Salary Income Tax Return?

Salary Income Tax Return Form is to be used by an individual who is a resident other than not ordinarily resident, whose total income for the assessment year 2019-20 does not exceed Rs. 50 lakh and who has income under the following heads:-

- Income from Salary/ Pension; or

- Income from One House Property; or

- Income from Other Sources.

NOTE: Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used only if the income being clubbed falls into the above income categories.

Who is not eligible to use this Return Form?

A. This Return Form should not be used by an individual who –

- is a Director in a company;

- has held any unlisted equity shares at any time during the previous year;

- has any asset (including financial interest in any entity) located outside India;

- has signing authority in any account located outside India; or

- has income from any source outside India.

B. This return form also cannot be used by an individual who has any income

of the following nature during the previous year:-

- Profits and gains from business and professions;

- Capital gains;

- Income from more than one house property;

- Income under the head other sources which is of following nature:-

(i) winnings from lottery;

(ii) activity of owning and maintaining race horses;

(iii) income taxable at special rates under section 115BBDA or section 115BBE; - income to be apportioned in accordance with provisions of section 5A; or

- agricultural income in excess of ₹5,000.

C. Further, this return form also cannot be used by an individual who has any

claims of loss/deductions/relief/tax credit etc. of the following nature:-

- any brought forward loss or loss to be carried forward under the head‗Income from house property‘;

- loss under the head ‗Income from other sources‘;

- any claim of relief under section 90 and/or section 91;

- any claim of deduction under section 57, other than deduction under clause (iia) thereof (relating to family pension); or

- any claim of credit of tax deducted at source in the hands of any other person.

The Major Changes which are made in the ITR 1 for the AY 2019-20 are:

- ITR 1 form for FY 2018-19 is not applicable to an individual who is either a director of a company or has invested in unlisted equity shares.

- Under Part A, ‘Pensioners’ checkbox has been introduced under the ‘Nature of employment’ section.

- Return filed under section has been segregated between normal filing and filed in response to notices.

- Deductions under salary will be bifurcated into standard deduction, entertainment allowance and professional tax.

- The taxpayers will be required to provide income wise detailed information under the ‘Income from other sources’.

- A separate column is introduced under ‘Income from other sources’ for deduction u/s 57(iia) – in case of family pension income.

- ‘Deemed to be let out property’ option now available under ‘Income from house property’.

- Section 80TTB column has been included for senior citizens.

| Section | Deduction on | Allowed Limit (maximum) FY 2018-19 |

|---|---|---|

| 80C | Investment in PPF

| Rs. 1,50,000 |

| 80CCC | For amount deposited in annuity plan of LIC or any other insurer for a pension from a fund referred to in Section 10(23AAB) | – |

| 80CCD(1) | Employee’s contribution to NPS account (maximum up to Rs 1,50,000) | – |

| 80CCD(2) | Employer’s contribution to NPS account | Maximum up to 10% of salary |

| 80CCD(1B) | Additional contribution to NPS | Rs. 50,000 |

| 80TTA(1) | Interest Income from Savings account | Maximum up to 10,000 |

| 80TTB | Exemption of interest from banks, post office, etc. Applicable only to senior citizens | Maximum up to 50,000 |

| 80GG | For rent paid when HRA is not received from employer | Least of : – Rent paid minus 10% of total income – Rs. 5000/- per month – 25% of total income |

| 80E | Interest on education loan | Interest paid for a period of 8 years |

| 80EE | Interest on home loan for first time home owners | Rs 50,000 |

| 80CCG | Rajiv Gandhi Equity Scheme for investments in Equities | Lower of – 50% of amount invested in equity shares; or – Rs 25,000 |

| 80D | Medical Insurance – Self, spouse, children Medical Insurance – Parents more than 60 years old or (from FY 2015-16) uninsured parents more than 80 years old | – Rs. 25,000 – Rs. 50,000 |

| 80DD | Medical treatment for handicapped dependent or payment to specified scheme for maintenance of handicapped dependent – Disability is 40% or more but less than 80% – Disability is 80% or more | – Rs. 75,000 – Rs. 1,25,000 |

| 80DDB | Medical Expenditure on Self or Dependent Relative for diseases specified in Rule 11DD – For less than 60 years old – For more than 60 years old | – Lower of Rs 40,000 or the amount actually paid – Lower of Rs 1,00,000 or the amount actually paid |

| 80U | Self-suffering from disability : – An individual suffering from a physical disability (including blindness) or mental retardation. – An individual suffering from severe disability | – Rs. 75,000 – Rs. 1,25,000 |

| 80GGB | Contribution by companies to political parties | Amount contributed (not allowed if paid in cash) |

| 80GGC | Contribution by individuals to political parties | Amount contributed (not allowed if paid in cash) |

| 80RRB | Deductions on Income by way of Royalty of a Patent | Lower of Rs 3,00,000 or income received |

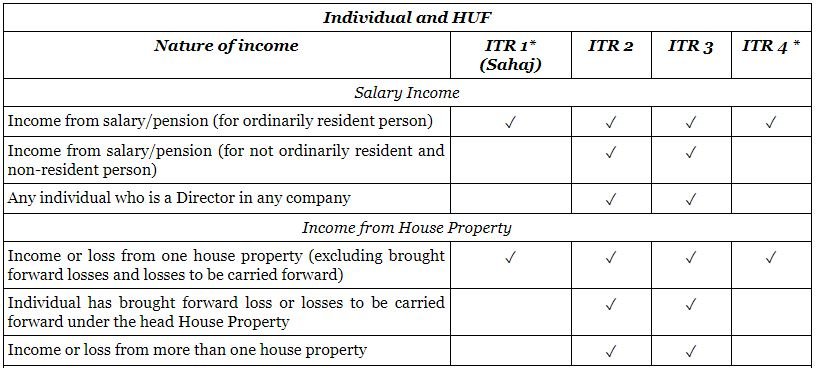

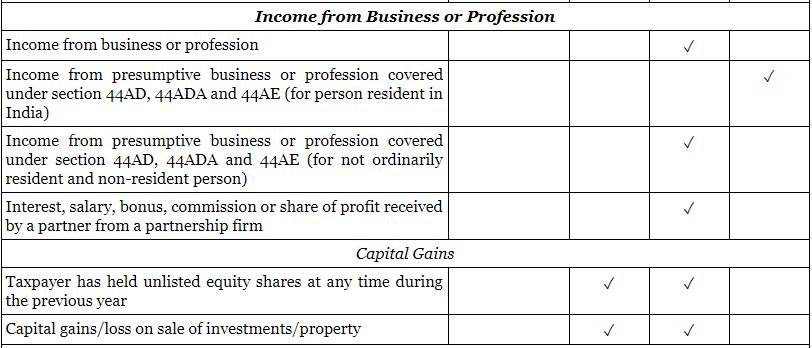

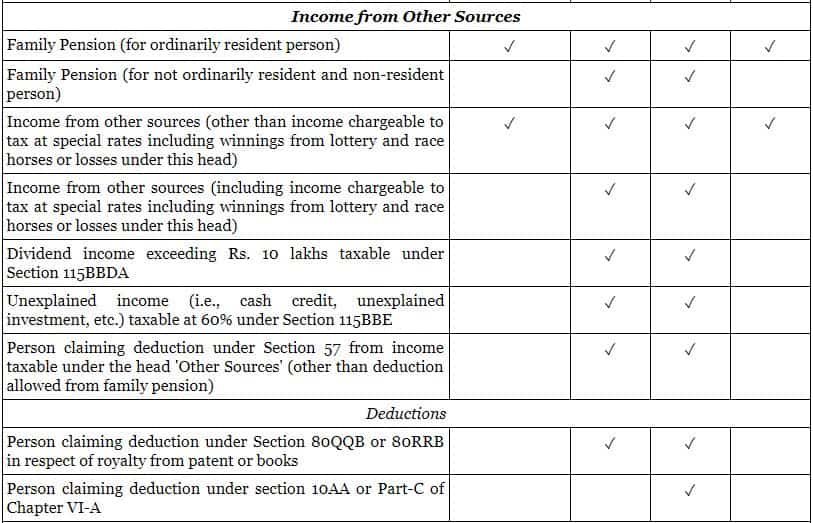

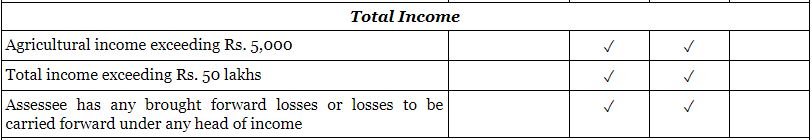

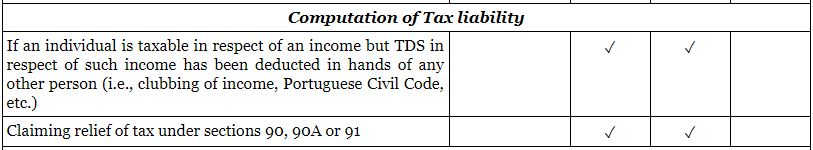

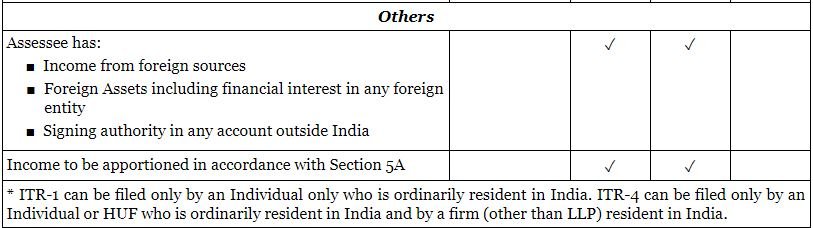

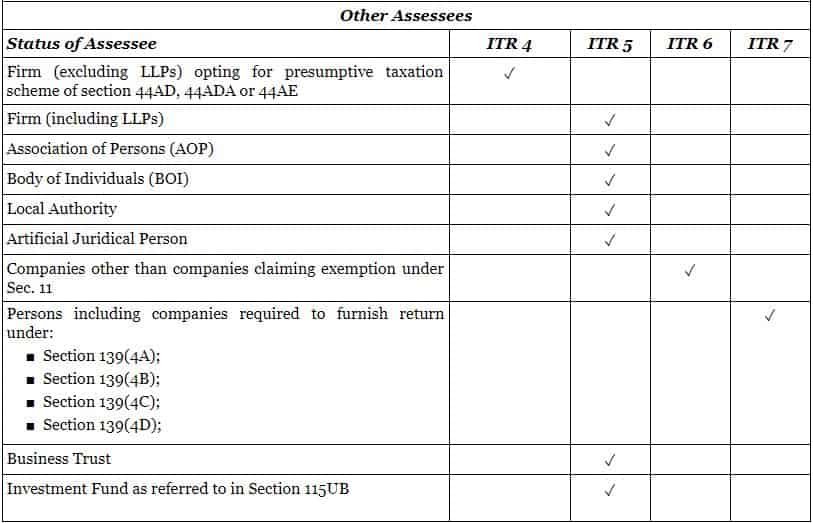

Which ITR Form is to be used for filing of return?

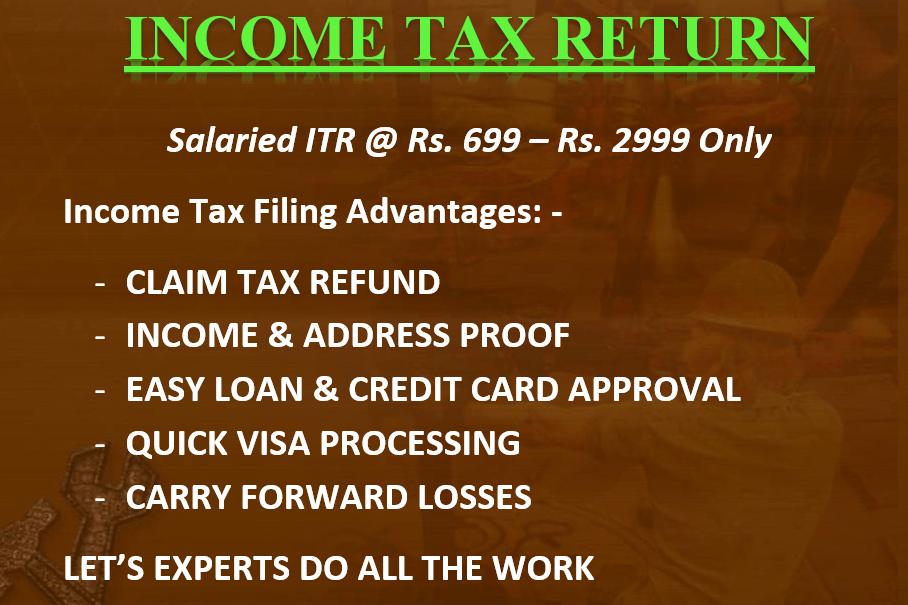

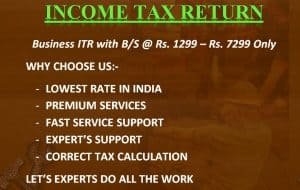

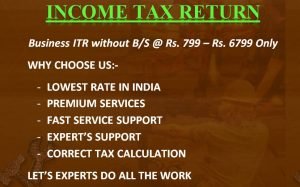

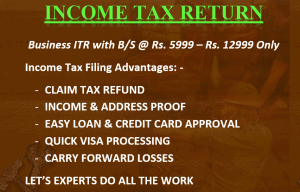

Salary Income Tax Return Filing Process:-

- Add service to cart

- Click on view cart

- Apply coupon (if have any)

- Proceed to checkout

- Fill the information & pay the amount.

- After receiving payment our executive will mail & call you to provide documents.

- After receiving necessary documents, our professional team will calculate the tax.

- We will inform you to pay the tax.

- After payment of tax, we will finish the work & forward you ITR Acknowledgement & ITR Form.

OR

You can call our team on below number to start or know about the Salary Income Tax Return Filing or any other services.

Mobile No – 8810627935, 8802444969

Email – info@infinitycompliance.in

Sorry!!!

Currently No Offer Available

Please check back later…

Or

Call our executive to get one

8810627935, 8802444969

Frequently Asked Questions:-

It is a tax levied by the Government of India on the income of every person. The provisions governing the Income-tax are covered in the Income-tax Act, 1961.

Income-tax is to be paid by every person. The term ‘person’ as defined under the Income-tax Act under section 2(3) covers in its ambit natural as well as artificial persons.

For the purpose of charging Income-tax, the term ‘person’ includes Individual, Hindu Undivided Families [HUFs], Association of Persons [AOPs], Body of individuals [BOIs], Firms, LLPs, Companies, Local authority and any artificial juridical person not covered under any of the above.

Thus, from the definition of the term ‘person’ it can be observed that, apart from a natural person, i.e., an individual, any sort of artificial entity will also be liable to pay Income-tax.

Allowances are fixed periodic amounts, apart from salary, which are paid by an employer for the purpose of meeting some particular requirements of the employee. E.g., Tiffin allowance, transport allowance, uniform allowance, etc.

There are generally three types of allowances for the purpose of Income-tax Act – taxable allowances, fully exempted allowances and partially exempted allowances.

Perquisites are benefits received by a person as a result of his/her official position and are over and above the salary or wages. These fringe benefits or perquisites can be taxable or non-taxable depending upon their nature. . Uniform allowance is exempt to the extent of expenditure incurred for official purposes u/s 10(14).

Yes. However, pension received from the United Nations Organisation is exempt.

An exempt income is not charged to tax, i.e., Income-tax Law specifically grants exemption from tax to such income. Incomes which are chargeable to tax are called as taxable incomes.

Yes, you will have to pay self-assessment tax and file the return of income.

section 17 of the Income-tax Act defines the term ‘salary’. However, not going into the technical definition, generally whatever is received by an employee from an employer in cash, kind or as a facility [perquisite] is considered as salary.

No, it is taxable as income from other sources.

Return Form ITR – 1 (SAHAJ) can be used by an individual whose total income includes:

(1) Income from salary/pension; or

(2) Income from one house property (excluding cases where loss is brought forward from previous years); or

(3) Income from other sources (excluding winnings from lottery and income from race horses, income taxable under section 115BBDA or Income of the nature referred to in section 115BBE).

Further, in a case where the income of another person like spouse, minor child, etc., is to be clubbed with the income of the taxpayer, this return form can be used only when such income falls in any of the above categories.

Income-tax is levied on the annual income of a person. The year under the Income-tax Law is the period starting from 1st April and ending on 31stMarch of next calendar year. The Income-tax Law classifies the year as (1) Previous year, and (2) Assessment year.

The year in which income is earned is called as previous year and the year in which the income is charged to tax is called as assessment year.

e.g., Income earned during the period of 1st April, 2019 to 31st March, 2020 is treated as income of the previous year 2019-20. Income of the previous year 2019-20 will be charged to tax in the next year, i.e., in the assessment year 2020-21.

Form-16 is a certificate of TDS. In your case it will not apply. However, your employer can issue a salary statement.

Yes, these are in the nature of perquisites and should be valued as per the rules prescribed in this behalf.

Reviews

There are no reviews yet.