Description

What is GSTR-9 Annual Return?

GSTR 9 is the annual return. It is a compilation return which includes all business transactions done for the particular Financial Year. GSTR-9 consists of details about the supplies made and received during the year under different tax heads i.e., CGST, SGST, and IGST. It consolidates the information furnished in the monthly/quarterly returns during the particular year.

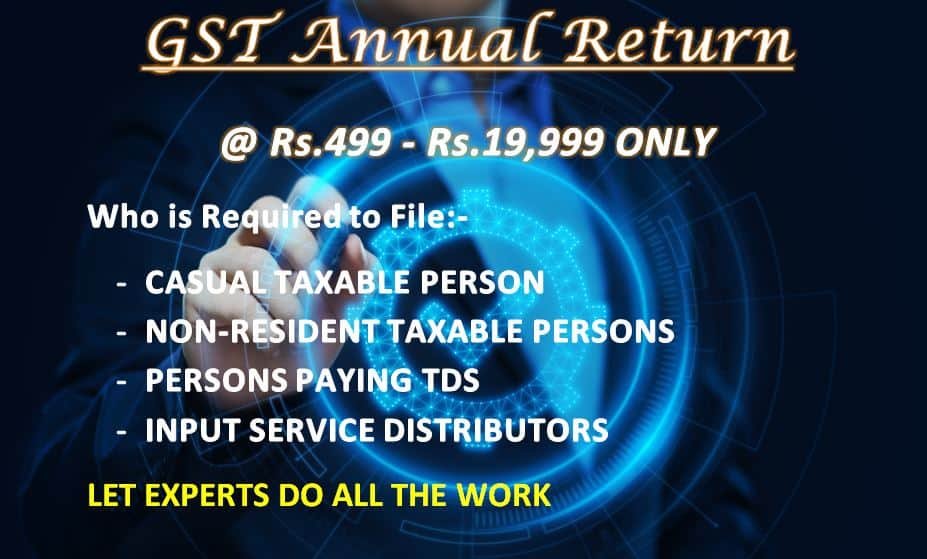

– Who is Required to File GSTR 9 (GST Annual Return Form)?

All the registered regular taxpayers are required to file a form under the GST regime.

- Casual Taxable Person

- Non-resident taxable persons

- Persons paying TDS

- Input service distributors

– What is the due date of GSTR-9?

GSTR-9 is to be filed on or before 31st December of the subsequent financial year. However, the Government has the power to extend this due date to such due date, as it deems necessary.

(For instance, for FY 2017-18, the due date for filing GSTR 9 has been extended to 30th June 2019*)

(For FY 2018-19 the due date for filing GSTR 9 is 31st December 2019*)

– What is the Penalty for the late filing of GSTR-9 form?

Details required in the GSTR-9 form

Serial Number | Parts of the GSTR-9 | Information required |

| 1 | Part-I | Basic details of the taxpayer. This detail will be auto-populated. |

| 2 | Part-II | Details of Outward and Inward supplies declared during the financial year(FY). This detail must be picked up by consolidating summary from all GST returns filed in previous FY. |

| 3 | Part-III | Details of ITC declared in returns filed during the FY. This will be summarised values picked up from all the GST returns filed in previous FY. |

| 4 | Part-IV | Details of tax paid as declared in returns filed during the FY. |

| 5 | Part-V | Particulars of the transactions for the previous FY declared in returns of April to September of current FY or up to the date of filing of annual returns of previous FY whichever is earlier. Usually, the summary of amendment or omission entries belonging to previous FY but reported in Current FY would be segregated and declared here. |

| 6 | Part-VI | Other Information comprising details of: |

| -GST Demands and refunds, | ||

| -HSN wise summary information of the quantity of goods supplied and received with its corresponding Tax details against each HSN code, | ||

| -Late fees payable and paid details and | ||

| -Segregation of inward supplies received from different categories of taxpayers like Composition dealers, deemed supply and goods supplied on approval basis. |

GSTR-9 Format

Frequently Asked Questions:-

– Is it mandatory to file Form GSTR-9?

Yes, it’s mandatory to file Form GSTR-9 for normal taxpayers.

– Can GSTR-9 be filed even in the case of Nil Turnover?

Yes, it is mandatory to file NIL Return.

– Can I revise the GSTR-9 which has been filed?

No. Currently, GSTR-9 does not allow for any revision after filing.

– What if your GSTN is Cancelled?

Even if your GSTN is cancelled, say during FY 2017-18, taxpayers are required to file GSTR-9.

– What if opted out or in Composition Dealer during the year?

If you have opted out or in Composition Dealer during the year, the taxpayer needs to file GSTR-9 and GSTR- 9A for the relevant periods.

– Will transactions for the period before July 2017 be included in GSTR-9?

No, transactions for the period before July 2017 will not be included in GSTR-9 because the GST authority has said that only the details for the period between July 2017 to March 2018 will be considered while filing the GSTR-9.

– Whether form GSTR-9 return is required to be filed at the entity level or GSTIN level?

Form GSTR-9 return is required to be filed at GSTIN level i.e. for each registration. If taxpayer has obtained multiple GST registrations, under the same PAN, whether in the same State or different States, he/she is required to file annual return for each registration separately, where the GSTIN was registered as a normal taxpayer for some time during the financial year or for the whole of the financial year.

– What is the Reconciliation statement in the GST Audit?

With annual audit form GSTR 9C, the taxpayer must also submit a reconciliation statement along with the GST audit certification. The reconciliation statement is the extra details given with GSTR 9C, which confirms the reconciliation of data according to GST annual return as per the accounts book and data.

– Can GSTR-9 be filed if the taxpayer has not filed GSTR-1 and GSTR-3B?

GSTR-9 cannot be filed unless GSTR-3B and GSTR-1 are filed.

– Can additional liability be paid?

Liability identified during the filing of annual return can be deposited with Government using DRC-03 Form (i.e., Liability not earlier paid through GSTR-3B)

– Can additional ITC be claimed?

ITC which is not claimed in GSTR-3B cannot be claimed in GSTR-9. Also, the same needs to be claimed in GSTR-3B upto the extended timeline for claiming input credit.

Different types of Annual Return

GSTR 9A

Annual return applicable for registered persons under Composition Scheme

GSTR 9C

Every registered person under GST whose aggregate turnover during a financial year exceeds two crore rupees, would need to get his accounts audited as specified under sub-section (5) of section 35. A copy of the audited annual accounts and a reconciliation statement, duly certified, should be furnished in form GSTR 9C.

Reviews

There are no reviews yet.