Description

Annual Compliance (Proprietorship)

Sole Proprietorship's of India have only the minimal statutory compliance, which are much lesser than those applicable to the private or public limited companies. It is mainly because of the fact that a sole proprietorship has a no separate legal entity different from its owner or proprietor, and this form of business entity does not avail the benefits of limited liability. The annual income of the proprietor is considered the annual income of the sole proprietorship firm.

Hence, like other business/service entities which are registered under the Ministry of Corporate Affairs, the sole proprietorship firms are not required to file any annual report or financial statements with the MCA. The main and major statutory compliance to be made by these proprietorship firms are thus tax related periodic and annual compliance. However, some more periodic or annual compliance may also be required for the purposes of business regulation/recognition. Thus, the major compliance for proprietorship's in India, are the following:

- Accounting & Book Keeping

- GST Returns

- Annual Income Tax Returns

- TDS Returns

Accounting & Book Keeping

All Proprietors are required to maintain accounts, ledgers and prepare financial statements at the end of each financial year.

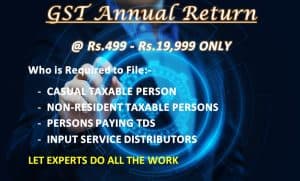

GST Return Filing

GST Return Filing are mandatory returns for all proprietorship firms who obtain GST Registration. GST Returns are filed on monthly, quarterly & annually basis.

Income Tax Return

Income tax filing must be filed by all proprietorship’s firms having a taxable income over the exemption threshold. Tax Audit must be required if turnover is more than 1 crore*.

TDS Return Filing

TDS Return is also required to be filed by the proprietor who have TAN Number and are also required to deduct tax at source as per TDS Rules.

Annual Compliance Service Include :-

- Book keeping

- Accounting & Ledger Preparation

- Preparation of Profit & Loss Account

- Balance Sheet Preparation

- GST Return Filing

- Annual GST Return Filing

- TDS Return Filing

- Business Income Tax Return Filing

Process:-

- Add service to cart

- Click on view cart

- Apply coupon (if have any)

- Proceed to checkout

- Fill the information & pay the amount.

- After receiving payment our executive will mail & call you to provide required documents.

- After receiving necessary documents we will initiate the process.

- Our professional team will handle all your annual mandatory & required compliance.

OR

You can send mail or call our team on below mail/number to start or know about the Annual Compliance or any other services.

Reviews

There are no reviews yet.