How banks, mutual funds and companies will check if you have filed ITR

How banks mutual funds and companies will check if you have filed ITR

Effective from July 1, 2021, a person who has not filed ITR for the previous two financial years and the aggregate TDS and TCS deducted from payments made to him/her in each of these financial years exceeds Rs 50,000, then such person would be subjected to higher TDS rate.

Deductors of TDS/TCS like banks, mutual fund houses, etc can now check if you have filed ITR when your income crosses the TDS limit from July 1, and levy two times the TDS amount if you haven’t filed your tax return. For this purpose, the income tax department has launched a compliance check utility for tax deductors on the department’s reporting portal. Further, the tax department has prepared a list with names of taxpayers who have not filed their ITRs for the previous two fiscals, which can be used by deductors.

Here is a look at how financial institutions will check if individuals have filed ITR or not to see if higher tax has to be deducted from their income. Also, what a taxpayer can do if their name appears on the list of those who haven’t filed ITRs for the previous two years.

When will higher TDS/TCS be levied?

As per the announcement made in Budget 2021, if an individual satisfies the following conditions, then he/she will be subjected to a higher TDS/TCS rate:

a) If the individual has not filed an income tax return in the two previous financial years for which due date has expired as per section 139(1) of the Income-tax Act, 1961 and

b) Sum of TDS and TCS in each of the financial years is more than Rs 50,000

Chartered Accountant Naveen Wadhwa, DGM, Taxmann.com says, “If for the relevant financial years an individual has filed belated ITR or filed ITR in response to a notice from the tax department, then Section 206AB would not be applicable. It would mean that higher TDS would not be deducted on incomes.”

Applicability of GST on Reverse Charge Mechanism for Import of Service

Compliance check utility for sections 206AB and 206CCA

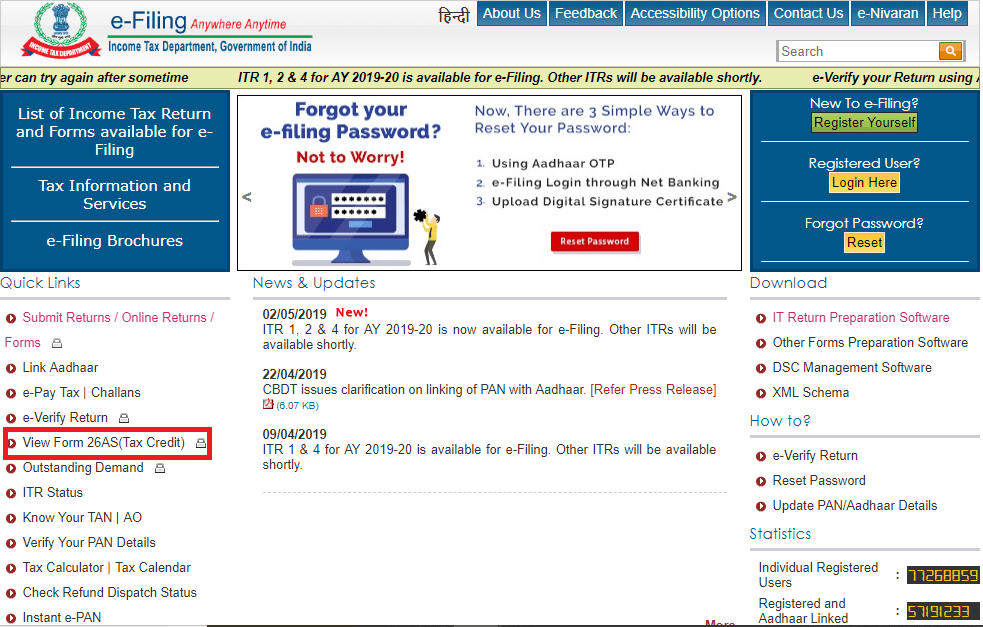

As mentioned above, a compliance check utility has been launched on the income tax department’s reporting portal: https://report.insight.gov.in/reporting-webapp/portal/homePage.

Here, if an individual comes under the purview of TDS, i.e., his income exceeds the specified limit, then the financial institution such as a bank, mutual fund, etc., would check if the tax on the income accrued would be deducted either at the normal rate (if the above-mentioned conditions are not satisfied) or at a higher rate as mentioned in the newly enacted law.

For instance, if the interest income from fixed deposit during the FY 2021-22 exceeds Rs 40,000 in a financial year, then the tax would be deducted on the interest income.

As per the circular, the tax deductor or collector can enter a single PAN or multiple PANs of the deductee or collectee on the reporting portal. The deductor or collector will get a response from the reporting portal if the TDS on the income of such a person would be deducted at a higher rate.

As per the functionality offered on the reporting portal, a list of persons is prepared by the tax department at the start of the financial year 2021-22. This contains name of taxpayers who have not filed ITR in the previous years, i.e., 2018-19 and 2019-20. These two financial years are taken as the relevant previous years where ITR was not filed and aggregate of TDS and TCS exceeded Rs 50,000 in each of the financial years.

Can your name be removed from the list?

The tax department’s June 22, 2021, circular states that if the specified person, i.e., the person whose name has appears on the list, files ITRs for FY 2018-19 and 2019-20 during the financial year 2021-22, then his name would be removed from the list. Wadhwa says, “The due date of filing ITR for FY 2018-19 and 2019-20 has expired on 30-11-2020 and 10-01-2021 respectively. Thus, an individual cannot file ITR now, unless notice is received from the income tax department to file ITR.”

If the taxpayer files valid ITR (i.e., filed and verified) for FY 2020-21, then his/her name would be removed from the list. Wadhwa says, “A taxpayer should ensure that once ITR is filed, it is immediately verified. The name from the list on the reporting portal would be removed either once the due date has expired (i.e., after September 30, 2021) or the date of filing valid return (filed & verified), whichever is later. Thus, if you have filed and verified ITR before the expiry date (September 30, 2021, for FY 2020-21), your name would be removed after the deadline expiry. However, if you file your ITR, say on September 25, 2021, and verify it on say October 15, 2021, then name from the list would be removed from the list after October 15, 2021.” As per income tax laws, a taxpayer can verify his/her return within 120 days of filing ITR.

However, no new names would be added to the list. Wadhwa says, “This would mean that banks, mutual funds or any other deductor would check only once during the FY 2020-21 at the time of deducting taxes from the income accrued. If the name does not appear on the list, then such deductor would continue to deduct taxes at normal rates throughout the year. However, if higher TDS is applicable and ITR for FY2020-21 is filed during the year, then an individual would have to inform the deductor, i.e., bank, mutual fund, etc. to check the list again after filing ITR and deduct TDS at a normal rate.”

Follow us at:-

Facebook – Follow Now

Instagram – Follow Now

Twitter – Follow Now