Indirect taxes replaced by GST

Welcome to Infinity Compliance,

What is Goods and Services Tax (GST)?

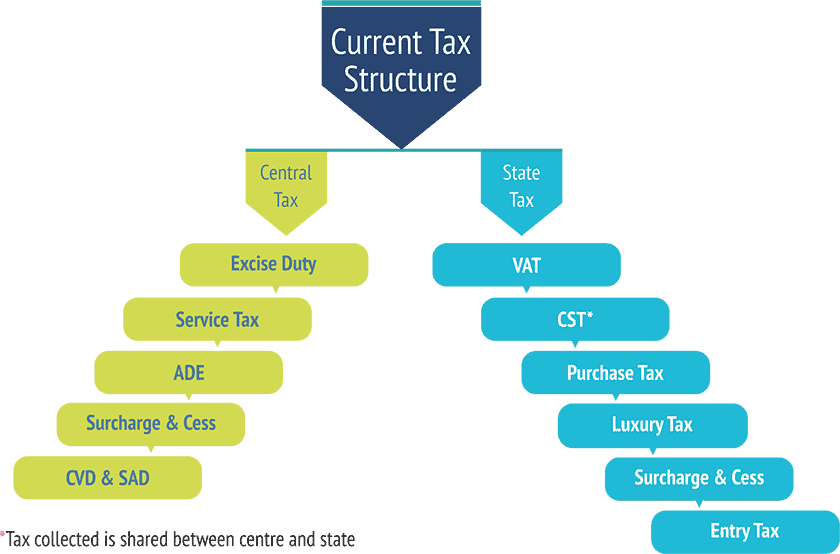

GST is a single uniform tax which was introduced to exchange Central and State indirect taxes like VAT, CENVAT, et al. . GST applies on all kinds of businesses, small or large. This makes it one among the best tax reforms within the country. The entire nation will follow a unified tax structure. As the name suggests, GST will be applicable on both goods and services and India will follow a dual system of GST to keep both the Centre and State independent of each other. The GST council are going to be headed by the Union minister of finance and it’ll contains various State Finance Ministers. GST are going to be devised as a four-tiered tax structure with tax slabs 5%, 12%, 18%, and 28% for various different categories of products and services. 0% rate is kept for the most essential goods such as rice, wheat.

The Central Taxes Replaced by GST

The introduction of the GST has replaced the following taxes, which was levied earlier.

- Central excise duty

- Central sales tax

- Service tax

- Additional duties of customs

- Additional duties of excise

- Excise duty levied under the textiles and textile products

The State-level Taxes Replaced by GST

- Purchase tax

- Central sales tax

- VAT

- Surcharge and CESS

- Entry tax

- Taxes on lottery, gambling, and betting

- Taxes on advertisements

Taxes Not Covered by GST

- Property Tax & Stamp Duty

- Electricity Duty

- Excise Duty on Alcohol

- Basic Custom Duty

- Petroleum crude, Diesel, Petrol, ATF & Natural Gas

Benefits of GST

As mentioned earlier, GST will unify the taxation system in the entire nation. This will help in removal of the cascading tax effect. Cascading effect refers to tax to be paid on a tax. Under GST, this may not happen because the unified tax will bring the whole tax system under one umbrella. Another important benefit is that under GST, the input tax credit is availed on both goods and services, which eliminates the cascading effect. GST also will unify the returns and compliances as there’ll no separate VAT and service tax. Read our article to know all the benefits of GST.

Who are the taxable persons under GST?

A taxable person under GST is a one that is registered or who is required to get registration as per the GST Act. As per the GST Act, taxable persons under GST may include

- Individuals

- Companies (Private or Public)

- Hindu Undivided Family (HUF)

- Partnership Firm

- Limited Liability Partnership (LLP)

- Any Government company or corporation

- Co-operative Societies

- Body of Individuals (BOI) or Association of Person (AOP)

- Any local authority or trust

What is a GSTIN?

GSTIN is analogous to the prevailing TIN number (Tax Identification Number). A Taxable person although already registered under GST would need to apply for registration as tax deductor. People can apply for GST registration in Form GST REG-06 for principal place of business and for extra place of business that’s available on a standard portal. This registration is valid for all places of business in a state.

Format of GSTIN Number

On approval of the application, a Goods and Service Tax Identification Number (GSTIN) is assigned, based on the following format:

- First two character for the State Code

- Next ten characters for the PAN or the Tax deductions and Collection Account Number

- Next two characters for the entity code

- Last digit is a check sum character

What is Reverse Charge?

Usually, when the supplier supplies goods, the tax is levied upon the supplier. In certain cases, the tax is levied upon the customer of the products. This is called reverse charge because the chargeability of tax gets reversed. This is not new under GST, as under the previous VAT regime, the reverse charge existed, but only on services. Now, under GST, it’ll be applicable on goods also.

What is continuous supply?

When goods and services are offered or supplied periodically (that is every fortnight or monthly, etc.), and payments also are made periodically, it’s called endless supply. For example, a telecom and internet provider will provide continuous supply because it is provided for an extended time, and also the payments are done monthly or quarterly.

What is a compliance rating?

The GST compliance rating is a performance rating that’s given to all or any registered taxpayers. This rating tells you how complaint the supplier are going to be with reference to GST provisions. This gives an option for the buyer to choose the seller based on the GST compliance rating. The scoring system are often devised on a scale of 1 to 10, supported the sort of business, with 10 being the very best complaint and 1 being the smallest amount complaint.