Online Business Registrations (START YOUR BUSINESS)

Online Business Registrations (START YOUR BUSINESS)

BASIC PROPRIETORSHIP FIRM

- 3 – 5 Days Registration Process

- Get Every Update On Mail

- Track Application Status Online

- Pay Via Payment Gateway

- Premium Customer Support

- Get Proprietorship Certificate

BASIC PARTNERSHIP FIRM

- 10 – 15 Days Registration Process

- Get Every Update On Mail

- Track Application Status Online

- Pay Via Payment Gateway

- Premium Customer Support

- Get Partnership Deed & PAN/TAN

LIMITED LIABILITY PARTNERSHIP

- 15 – 21 Days Registration Process

- Get Every Update On Mail

- Track Application Status Online

- Pay Via Payment Gateway

- Premium Customer Support

- Get DIN, DSC , RC & LLP AGREEMENT

PRIVATE LIMITED COMPANY

- 7 – 8 Days Registration Process

- Get Every Update On Mail

- Track Application Status Online

- Pay Via Payment Gateway

- Premium Customer Support

- Get DIN, DSC, MOA, AOA & RC

Apply for Tax Registration (GOODS & SERVICES TAX)

Eligibility –

Any person or entity supplying goods or services in India above the aggregate turnover limit is mandatorily required to obtain GST registration.

Turnover Limit –

-

40 Lakh for Goods Suppliers*

-

20 Lakh for Service Providers*

-

Mandatory for Interstate Supply

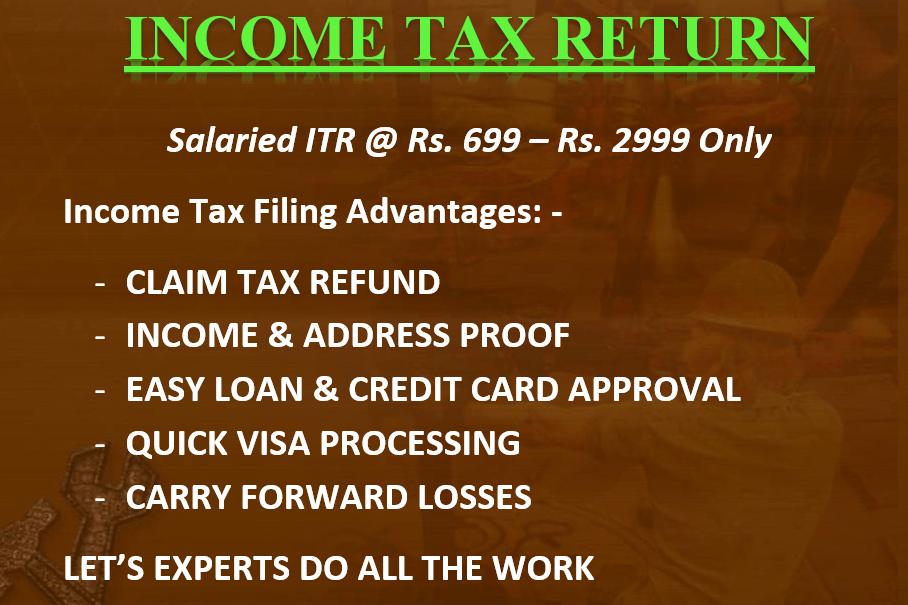

Online eFiling (PAY YOUR TAXES)

Online eFiling Service (PAY YOUR TAXES)

12th Months Compliance (COMPLETE PACKAGE)

12th Months Compliance (COMPLETE PACKAGE)

PROPRIETORSHIP COMPLIANCE

- Book keeping

- Accounting & Ledger Preparation

- Preparation of Profit & Loss Account

- Balance Sheet Preparation

- GST Return Filing

- Annual GST Return Filing

- TDS Return Filing

- Business Income Tax Return

PARTNERSHIP COMPLIANCE

- Book keeping

- Accounting & Ledger Preparation

- Preparation of Profit & Loss Account

- Balance Sheet Preparation

- GST Return Filing

- Annual GST Return Filing

- TDS Return Filing

- Business Income Tax Return Filing

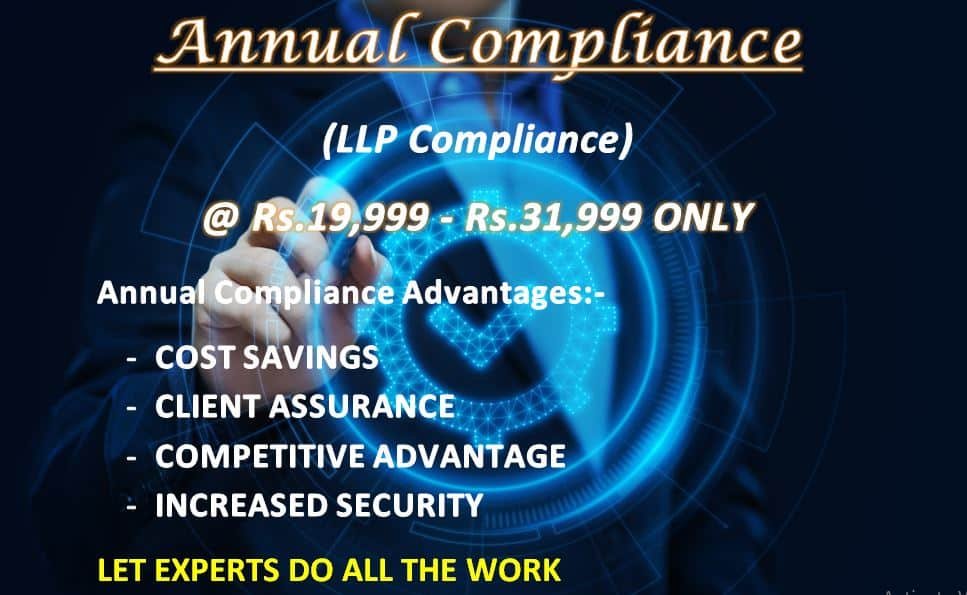

LLP COMPLIANCE

- Filing of Annual Return (LLP Form 11)

- Filing of Statement of Account & Solvency (LLP Form 8)

- Maintenance of records

- Other compliances

- Income Tax Compliances

- GST Returns

- TDS Returns

PVT LTD COMPLIANCE

- Appointment of Auditor

- Statutory Audit of Accounts

- Filing of MGT-7 & AOC-4

- Annual general meeting

- Preparation of Directors’ Report

- Maintenance of records

- Other compliances

- Income Tax Compliances

- GST Returns

- TDS Returns

Apply for MSME (UDYOG AADHAR REGISTRATION)

Eligibility –

Not all businesses can obtain Udyog Aadhaar registration. Only those entity that are classified as a micro, small or medium enterprise as per the table based on investment in plant and machinery is eligible for Udyog Aadhaar.

Industry | Manufacturing Sector | Service Sector |

Micro-Enterprise | Investment of up to Rs. 25 lakhs in plant and machinery | Investment of up to Rs. 10 lakhs equipment |

Small Enterprise | Investment of up to Rs. 5 crores in plant and machinery | Investment of up to Rs. 2 crores in equipment |

Medium Enterprise | Investment of up to Rs. 10 crores in plant and machinery | Investment of up to Rs. 5 crores investment in equipment |